Money laundering might sound like something out of a spy movie, but it’s a very real—and very serious—issue that affects financial institutions around the world. Whether you’re in finance, compliance, or just curious about how illicit money gets cleaned, the Anti-Money Laundering Concepts: AML, KYC and Compliance course on Udemy is a fast, no-fluff way to get a solid understanding of the fundamentals.

Touted as the course with the highest number of students enrolled in its category, it promises to deliver practical knowledge in under two hours. So, is it worth your time? Let’s break it down.

Instructor Reputation

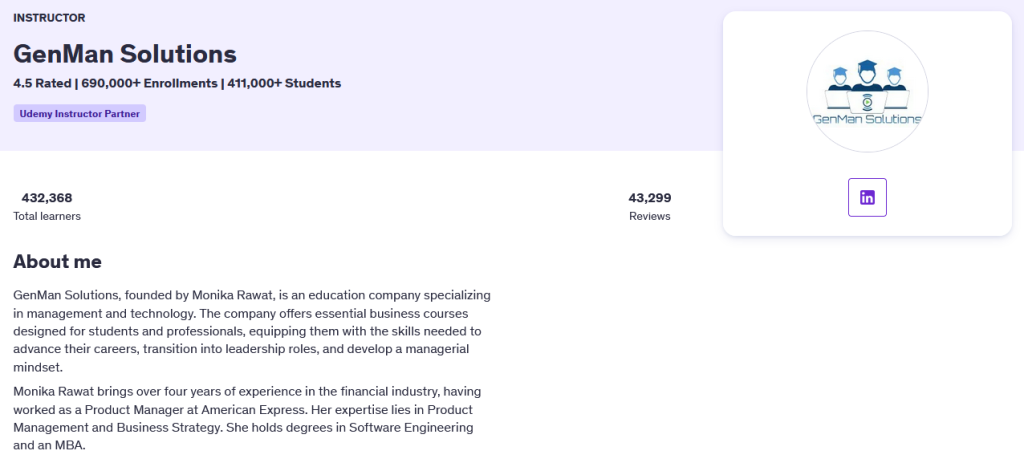

When it comes to online courses, the quality of the instructor can make or break the experience. In this case, GenMan Solutions, founded by Monika Rawat, delivers a course that feels both credible and approachable. GenMan Solutions has built a reputation for providing accessible and high-impact business and management training on Udemy. With over 432,000 students and more than 43,000 reviews, it’s clear they’re doing something right—and this course is one of their most popular offerings to date.

Monika Rawat herself is no stranger to the world of finance and compliance. With a background in Software Engineering and an MBA, she has the technical know-how and business mindset to teach nuanced topics like AML in a way that connects. What gives her an edge, though, is her real-world experience—particularly her time as a Product Manager at American Express, where she worked at the intersection of technology, customer experience, and financial regulation.

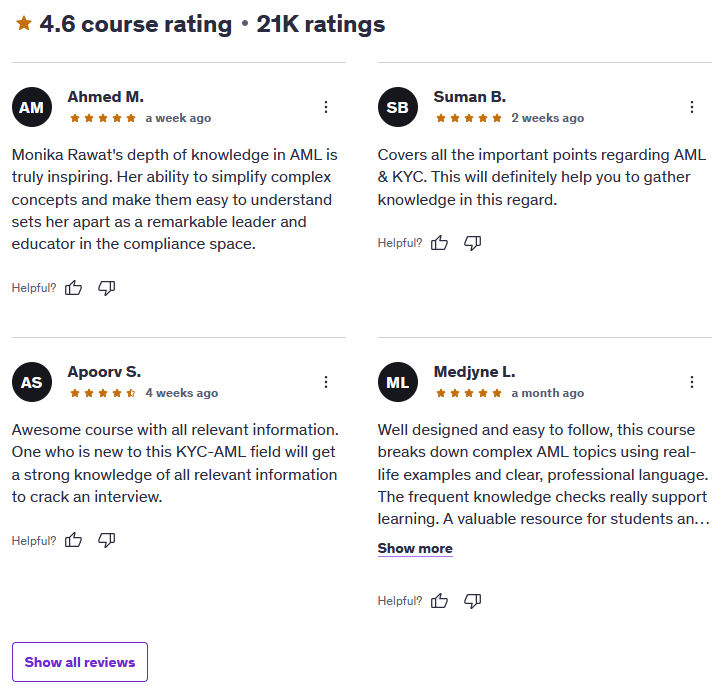

Students consistently praise Monika’s ability to demystify dense material. She doesn’t just throw acronyms at you—she walks you through their significance with practical examples, real-life analogies, and step-by-step breakdowns. Reviews often mention how her style feels calm, deliberate, and clear, making even the driest parts of compliance easier to digest.

One student noted, “Monika’s depth of knowledge in AML is truly inspiring… she makes difficult concepts feel manageable.” Another echoed that sentiment, pointing out that “The structure and clarity she brings to each module shows her deep understanding of the topic and her focus on real-world application.”

This course feels less like a lecture and more like a well-organized workshop, thanks to Monika’s ability to teach with intent and keep things relatable without oversimplifying. It’s this blend of professional credibility and teaching skill that makes her—and GenMan Solutions—stand out in the crowded field of Udemy instructors.

Course Structure

The structure of Anti-Money Laundering Concepts: AML, KYC and Compliance is one of its biggest strengths, especially if you’re someone who values clarity, pacing, and a logical progression of topics. At just under two hours, it may sound like a quick overview, but don’t be fooled—the course is surprisingly comprehensive for its length. It’s the perfect mix of brevity and depth.

The course begins by laying the foundation of money laundering—what it is, how it works, and why it’s such a critical issue in today’s financial world. Rather than jumping straight into technical jargon, the instructor first introduces the context and consequences of money laundering, which helps learners understand the “why” before diving into the “how.”

From there, it moves into terrorist financing, offering side-by-side comparisons to money laundering and helping you understand the legal and regulatory frameworks that attempt to counteract both. These sections are particularly helpful for anyone working in banking, fintech, or law enforcement, where these distinctions matter a lot.

Next comes the meat of the course:

- AML Policies and Frameworks

- KYC (Know Your Customer) procedures

- Customer Due Diligence (CDD)

- Economic Sanctions and PEPs (Politically Exposed Persons)

- Red flags and indicators of suspicious activity

Each module is broken down into short, digestible lectures that are easy to follow, even if you’re completely new to the topic. The transitions between topics are smooth, and the course builds logically—concepts introduced early on are revisited and reinforced later, creating a nice sense of cohesion.

Another highlight of the course structure is its inclusion of scenario-based exercises and knowledge checks. These aren’t throwaway multiple-choice questions either—they reflect real-world situations and challenge you to think critically about how you’d apply what you’ve learned. This hands-on component really boosts retention and confidence.

And let’s not forget the lifetime access and 1-on-1 instructor support. This makes the course not just a one-time watch, but a reference tool you can revisit whenever you need to refresh your memory or brush up before an interview.

Whether you’re a working professional needing a structured primer or a student preparing for a compliance-focused career, this course’s thoughtful layout and logical flow make it an ideal starting point. It respects your time while still giving you all the core concepts needed to navigate AML and KYC with confidence.

Content Quality

The quality of content in this course is, in a word, impressive—especially when you consider that it’s under two hours long. Despite the compact runtime, it doesn’t feel rushed or shallow. Instead, it manages to strike a really effective balance between depth and accessibility, delivering critical knowledge in digestible chunks without sacrificing substance.

Right off the bat, the course does a great job establishing context. Rather than diving into terminology immediately, it starts by painting a clear picture of why Anti-Money Laundering (AML) matters. The early modules explain not just what money laundering is, but why it’s dangerous, how it impacts the global financial system, and why regulators crack down so hard on it. That sets the tone for everything that follows.

From there, the content smoothly progresses into more technical areas like terrorist financing, AML compliance policies, and KYC procedures, all of which are delivered in a clear, professional, yet friendly tone. These aren’t just textbook definitions either—the instructor provides real-life examples, draws on industry norms, and includes practice scenarios that make the learning stick. For example, the module on Politically Exposed Persons (PEPs) uses everyday analogies to explain what could otherwise be a dense and regulatory-heavy topic.

One of the course’s major strengths is its clarity. The language is straightforward, and industry jargon is either avoided or explained thoroughly. That makes this course ideal for non-native English speakers and people without prior experience in finance or compliance. Each module builds naturally on the previous one, which means you’re not jumping from one concept to another with no connective tissue in between.

Another standout element is the use of knowledge checks and quizzes, which don’t feel tacked on. They’re designed to reinforce learning and mimic the kinds of critical thinking skills you’d need in a real-world compliance or audit role. You’re not just memorizing definitions—you’re being asked to identify suspicious activity, analyze risk, and apply AML protocols, all in context.

The downloadable resources are minimal but well-selected, and the audio/video quality is crisp throughout. While the course could benefit from some visual enhancements—like infographics or animation to explain the AML process visually—this is a minor critique when the core content is this strong.

Overall, the course doesn’t just educate—it empowers. Whether you’re a beginner in the field or someone brushing up for a job interview, you’ll walk away with practical, applicable knowledge that holds up in both academic and professional settings.

Overall Course Rating – 9/10

If you’re looking for a fast but thorough entry point into the world of AML, Anti-Money Laundering Concepts: AML, KYC and Compliance deserves a solid 9 out of 10—and that’s not just based on its popularity. It earns that score by delivering substantive, high-quality content in a well-structured, easy-to-follow format, all led by a knowledgeable and engaging instructor.

What makes this course stand out is how much it accomplishes in such a short span of time. It’s less than two hours long, but thanks to its sharp focus, tight scripting, and seamless flow, you’ll come away with a full understanding of key AML and KYC concepts. That’s no small feat, especially considering how regulatory and jargon-heavy the subject matter can be.

The course offers real-world relevance, practical examples, and quizzes that encourage active learning—not just passive viewing. There’s no fluff, no filler, and no time-wasting. Every module has a purpose, and each one connects logically to the next. This helps build a mental model that actually sticks, which is especially useful for professionals preparing for job interviews, compliance audits, or certification prep.

Monika Rawat, via GenMan Solutions, brings a steady hand to the material. Her teaching style is relaxed but precise, making the course approachable for a wide range of learners. The value-add here isn’t just the information—it’s how the information is delivered. That’s a big part of why this course has become the most enrolled AML course on Udemy.

Could it be improved? Sure. Visual aids, more downloadable resources, or updated case studies on modern AML breaches would enhance the experience. But those are enhancements, not necessities. The core offering is excellent as-is.

In short, if you want a no-nonsense AML primer taught by someone who knows what they’re doing—and can explain it well—this course should be at the top of your list. It delivers exactly what it promises, and it does so with clarity, authority, and zero wasted time.