If you’ve ever felt overwhelmed trying to understand how payments actually work behind the scenes—you’re not alone. For anyone new to the financial services industry, the jargon, systems, and acronyms can feel like a maze. That’s where “Introduction to Payments“ on Udemy steps in. Taught by Rachit Sharma, this course is a beginner-friendly breakdown of everything you need to know about the payments domain.

Instructor Reputation

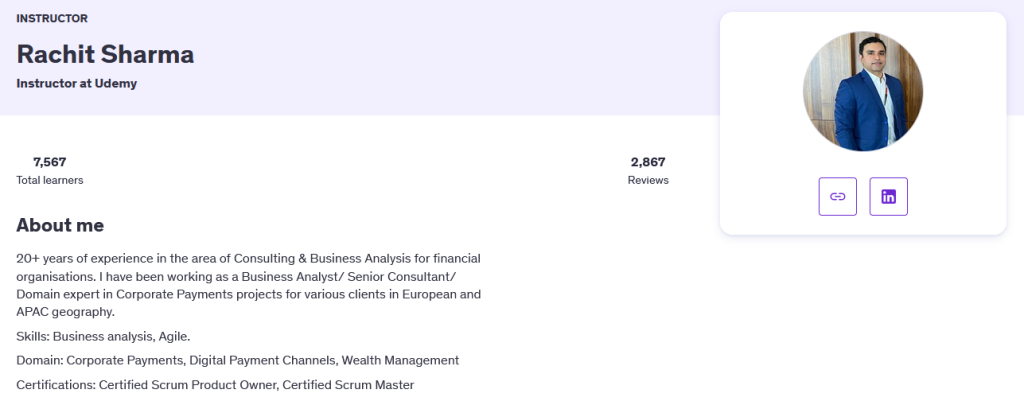

One of the standout strengths of this course is its instructor, Rachit Sharma, whose background is as impressive as it is practical. With over 20 years of experience in consulting and business analysis—particularly within the corporate payments and digital banking sectors—Rachit brings a level of expertise that’s both deep and hard-earned. He’s not someone teaching from theory alone; he’s been in the trenches, working on high-impact projects across Europe and the APAC region, helping major financial institutions streamline and optimize their payment operations.

But what really makes Rachit shine isn’t just his credentials—it’s his ability to relate to beginners. He kicks off the course with a refreshingly honest story about his own struggles as a newly minted MBA grad thrown into a payments project with zero background. That story sets the tone for the entire course: supportive, non-judgmental, and deeply empathetic.

As a Certified Scrum Master and Product Owner, he’s also fluent in agile project delivery—a major plus if you’re a Business Analyst, Product Manager, or anyone else who needs to bridge the gap between tech teams and business stakeholders. His experience with cross-functional roles means he doesn’t just talk about payments from a technical lens—he helps you understand why these systems matter in real-world business environments.

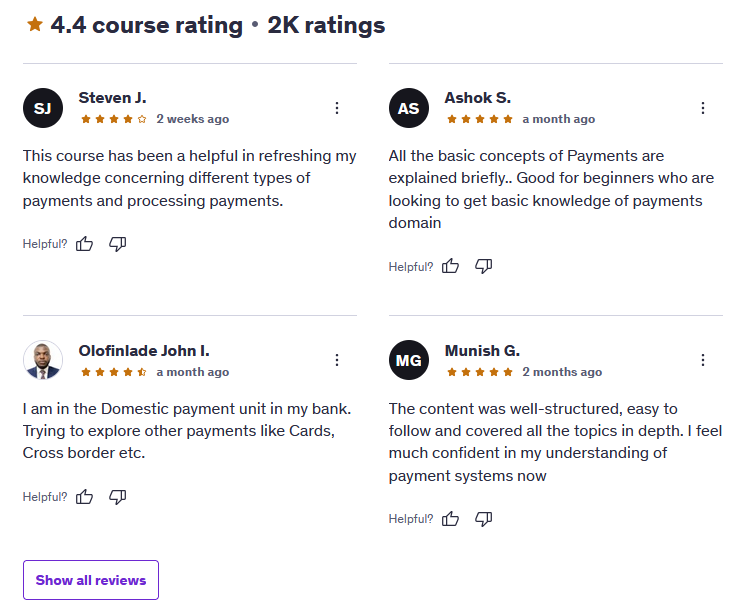

Rachit’s Udemy instructor profile shows a 4.5-star rating across nearly 3,000 reviews and a growing student base that’s already past 7,500 learners. That level of feedback doesn’t happen by accident. Students consistently point out his clarity, pacing, and real-world relevance as major reasons why this course works so well for absolute beginners. If you’re the kind of learner who appreciates not just information, but insight and mentorship, Rachit’s teaching style will feel like a breath of fresh air.

Course Structure

The structure of Introduction to Payments is one of its most effective teaching tools. Rather than throwing you into complex systems or niche use cases right away, the course starts from the ground up—laying a strong foundation before layering on more advanced concepts. This progression is essential for those who have zero experience in payments but need to get up to speed quickly for a job role, interview, or consulting assignment.

The course is divided into clearly labeled sections, each focusing on a distinct part of the payments ecosystem. It starts with the basics of payment sources and instruments—giving you an understanding of where payments originate and the various methods used to initiate them (e.g., cards, checks, wire transfers, etc.). From there, it builds toward a more nuanced view of the entities involved in the process, including customers, banks, clearing houses, and intermediaries.

Once those roles are clearly defined, the course walks you through the entire end-to-end payment lifecycle. You learn what actually happens between the moment someone clicks “Pay” and the funds hitting the recipient’s account. This includes a breakdown of transaction stages, authorization steps, message flows, and settlement protocols. It’s the kind of content that new Business Analysts or Product Owners often struggle to find in one place, and here it’s delivered with excellent clarity.

Another highlight is the section on messaging standards, where you’re introduced to formats like SWIFT MT/MX, ISO 20022, and others. These are typically intimidating topics, but Rachit simplifies them with straightforward explanations and real-world examples. This section alone can be a huge asset if you ever find yourself working on system integration projects or speaking with tech teams.

The course also devotes time to payment systems and products, including traditional rails like RTGS and NEFT, as well as more modern tools like UPI and digital wallets. Rachit even touches on emerging trends in the payment space, which gives learners a sense of where the industry is headed—something many beginner courses overlook.

Each lesson is short enough to be digestible but informative enough to feel substantial. There are no quizzes or assignments, but the logical flow and real-world framing make it easy to retain the information and apply it. Whether you’re prepping for a new job or just trying to understand how the money actually moves, the course layout helps demystify the topic step-by-step, without overwhelming you.

Content Quality

When it comes to content quality, Introduction to Payments truly stands out for its clarity, structure, and relevance. The course does an excellent job of turning a complex and jargon-heavy topic into something that’s approachable, digestible, and even enjoyable to learn. If you’ve ever tried to teach yourself payments using scattered articles, whitepapers, or corporate manuals, you’ll immediately appreciate the organized, step-by-step nature of this course.

One of the strongest aspects of the content is how it combines technical precision with plain English explanations. There’s no assumption that the learner has prior banking experience or technical know-how, which is a huge relief for those entering the payments space from other domains. Terms like “clearing,” “settlement,” “ACH,” and “real-time gross settlement” are broken down with examples that are easy to visualize and connect to real-world situations. You’re not just memorizing definitions—you’re gaining a working knowledge of how things actually function.

The course also offers a comprehensive look at both legacy and modern systems, something that many introductory courses often miss. It discusses traditional infrastructures like NEFT and RTGS but also includes emerging technologies like digital wallets, UPI, and even touches on trends shaping the future of payments. This blend of old and new ensures that learners get a well-rounded view of the landscape, making it easier to adapt to different project environments.

There’s also a subtle but impactful focus on professional application. Each section is framed in a way that encourages learners to think like a Business Analyst or Product Owner. For example, when the instructor explains messaging standards like SWIFT or ISO 20022, it’s not just a lecture on formats—it’s a breakdown of why those standards matter when you’re integrating systems or gathering requirements from stakeholders. That’s a huge win for learners who need to apply this knowledge at work.

And let’s not forget the pacing. The content is well-paced, logically sequenced, and refreshingly free of filler. Each video is tightly focused, which means you’re getting maximum value with minimum wasted time. For busy professionals or learners juggling multiple priorities, that efficiency is gold.

If there’s one area for improvement, it’s the lack of quizzes or practice scenarios that might help reinforce learning through application. However, the instructor’s clear explanations and practical framing do a solid job of compensating for that. Overall, the content feels polished, purposeful, and highly informative—making it one of the better introductory courses on this subject available online.

Overall Course Rating – 8.8/10

If you’re looking for a solid, beginner-friendly introduction to the world of payments, Introduction to Payments scores a well-deserved 8.8 out of 10 in our books. Right from the opening video, it’s clear that this course was built by someone who not only knows the subject inside and out but also remembers what it feels like to be new, confused, and eager to learn.

The course earns high marks for its depth of insight without overwhelming complexity. Whether you’re a Business Analyst freshly assigned to a fintech project, a QA tester trying to understand your domain better, or a developer working on payment integrations, this course provides a strong knowledge base to help you speak the language of the payments ecosystem.

Instructor Rachit Sharma is the heart of this course, and his empathetic teaching style is a major reason why it works so well. He breaks down difficult concepts with analogies, clear diagrams, and relatable examples, making even the most technical aspects feel manageable. The production quality of the course is also solid—there are no distractions, just well-structured, easy-to-follow video lessons that get straight to the point.

What really elevates the course, though, is its real-world orientation. This isn’t just a high-level overview for the sake of theory; it’s training designed to prepare you for on-the-job conversations, client meetings, and project deliverables. You’re not just learning how money moves—you’re learning how to analyze, explain, and improve those flows in a business context.

That said, there’s room to grow. Adding interactive elements like knowledge checks, simple quizzes, or downloadable process maps would enhance the experience further and help cement the learning. But for the price point and the audience it’s aimed at, this course already over-delivers.

In summary, Introduction to Payments is a smart investment for anyone stepping into the financial domain. It’s concise, practical, and taught by someone who’s clearly invested in helping others succeed. If you’re starting your journey in the world of payments, this course won’t just get you up to speed—it’ll give you the confidence to speak the language of the industry.