Ah, tax accounting… just the phrase alone is enough to send shivers down the spine of many a brave soul. But here comes Stefan Ignatovski, Ph.D., wielding his animated videos like a magic wand, attempting to turn what is traditionally a snoozefest into an engaging learning experience. And guess what? It looks like he’s onto something with his Udemy course, Tax Accounting Made Easy to Understand. Let’s dive into this whirlpool of numbers and see if it’s worth the swim.

Right off the bat, the course promises to make the daunting world of taxes easy to understand. The concept of learning tax accounting through animated videos? Genius! It’s like turning tax law into a cartoon that you actually want to watch. This isn’t your average, dry lecture series; it’s a creative take on demystifying the complexities of tax.

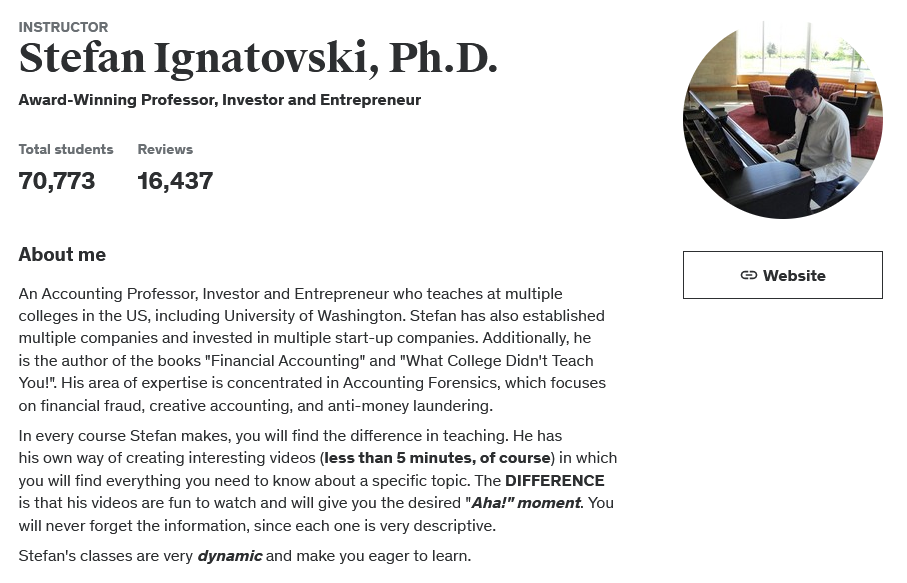

Instructor Reputation: The Guiding Light in the Maze of Tax Accounting

When it comes to learning, the instructor plays a pivotal role in not just imparting knowledge, but also in making the subject matter engaging and accessible. Stefan Ignatovski, Ph.D., is a beacon of expertise and innovation in the somewhat daunting world of tax accounting. With a 4.5 instructor rating amassed from over 16,000 reviews and a teaching portfolio that spans across 70,773 students and 10 courses, Ignatovski isn’t just another academic voice in the wilderness; he’s a proven leader in the field.

His background is as diverse as it is impressive. Serving as an Accounting Professor and having taught at prestigious institutions like the University of Washington, Ignatovski brings a wealth of knowledge to his courses. But it’s not just his teaching that makes waves; his real-world experience as an investor and entrepreneur adds a layer of practicality to his lessons that theory alone cannot provide. This blend of academic rigor and real-world insight is what sets his teaching apart.

Ignatovski’s accolades extend beyond the classroom. As an author of books such as “Financial Accounting” and “What College Didn’t Teach You!”, he has contributed valuable resources to the academic and practical understanding of accounting. His expertise in Accounting Forensics, focusing on areas like financial fraud, creative accounting, and anti-money laundering, adds a layer of depth to his teaching, making his courses rich with insights that are hard to find elsewhere.

The real magic, however, lies in Ignatovski’s unique teaching approach. He has embraced the power of animated video lectures to demystify complex tax accounting concepts, making them not only understandable but also enjoyable. This innovative method reflects his belief that learning should be exciting and memorable, a philosophy that resonates deeply with his students. The animated videos are not just a gimmick; they are a testament to Ignatovski’s commitment to making learning accessible and engaging for everyone, regardless of their background or level of expertise in the subject.

Course Structure: A Deep Dive into the World of Tax Accounting

The structure of Tax Accounting Made Easy to Understand is a meticulously crafted journey through the intricacies of tax law and its application. Ignatovski has designed the course to be comprehensive, covering a broad spectrum of topics that are essential for a robust understanding of tax accounting. The course kicks off with foundational concepts, ensuring that students grasp the basic principles of tax law, including the differentiation between Tax Avoidance and Tax Evasion, and an overview of the social, political, and economic factors influencing tax law.

As students progress, the course delves into more complex areas, such as interpreting the tax formula, understanding deductions and exclusions, and navigating the rules around deductions for losses and at-risk rules. Each section builds on the previous one, creating a layered understanding of tax accounting that is both deep and broad.

What sets this course apart is not just the range of topics covered but also the teaching methodology employed. Ignatovski utilizes animated videos for each lecture, breaking down complex topics into digestible, engaging lessons. This approach not only makes the content more accessible but also enhances retention by presenting information in a visually appealing and memorable format.

Moreover, the course is designed with flexibility in mind, catering to a wide array of learners from individuals and small business owners to CPA Candidates and accountants. Depending on the learner’s commitment, the course can be completed in a timeframe that ranges from a week to a few weeks, allowing for a self-paced exploration of the material.

The inclusion of practical exercises and “Knowledge Application” sections further enriches the learning experience. These segments encourage students to apply what they’ve learned in practical scenarios, reinforcing knowledge through active engagement. This hands-on approach ensures that students are not just passive recipients of information but active participants in their learning journey.

In summary, the structure of Tax Accounting Made Easy to Understand is a testament to Ignatovski’s deep understanding of both the subject matter and the art of teaching. By combining a comprehensive curriculum with an innovative delivery method, he has created a course that is both informative and immensely engaging, making the daunting world of tax accounting accessible to all.

Content Quality: A Rich Tapestry of Learning

The content quality of Tax Accounting Made Easy to Understand is a standout feature, marked by its depth, clarity, and innovative presentation. Stefan Ignatovski’s approach to demystifying the complexities of tax accounting through animated videos is not just a novel idea but a highly effective educational tool. These animations serve as a visual anchor, helping students to grasp complex concepts by transforming them into relatable and easily digestible visual narratives.

The course covers an impressive array of topics, ensuring that learners get a comprehensive understanding of tax accounting. From the basics of describing and applying tax law, distinguishing between tax avoidance and tax evasion, to more complex topics such as interpreting the tax formula, understanding deductions and exclusions, and mastering the rules for net operating losses, the course leaves no stone unturned. Each topic is meticulously explained with clear examples and practical applications, making the abstract concepts of tax law tangible and understandable.

The quality of the content is further enhanced by the practical exercises and application sections interspersed throughout the course. These exercises are not just afterthoughts but are carefully designed to reinforce the concepts taught in the lectures. By engaging with these exercises, students can apply what they’ve learned in real-world scenarios, enhancing their understanding and retention of the material. This hands-on approach is a critical component of the course’s success, bridging the gap between theoretical knowledge and practical application.

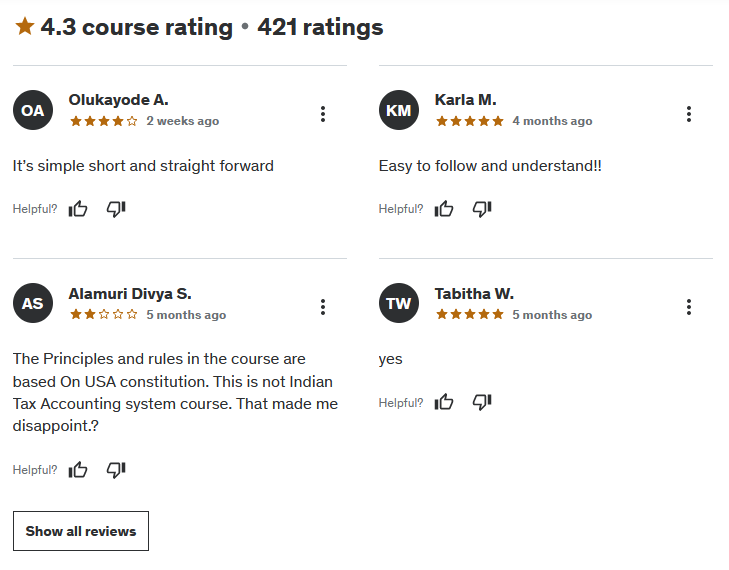

Feedback from students highlights the engaging nature of the course content and its effectiveness in making tax accounting interesting. Students have praised the course for its informative and engaging videos, high-quality exercises, and the practical applicability of the material. The course’s ability to transform a traditionally dry subject into an engaging and enjoyable learning experience is a testament to the quality of its content and Ignatovski’s skill as an educator.

Overall Course Rating: 9/10

Taking all aspects into consideration, Tax Accounting Made Easy to Understand earns a solid 9 out of 10. This rating reflects the course’s exceptional content quality, innovative teaching methods, comprehensive coverage of tax accounting topics, and the high level of student engagement and satisfaction.

The course’s standout feature is undoubtedly its use of animated videos to explain complex tax accounting concepts. This unique approach not only makes the content more accessible but also significantly enhances the learning experience, making it enjoyable and memorable. The animations, combined with Ignatovski’s clear and concise explanations, ensure that students can grasp difficult concepts more easily than through traditional teaching methods.

Additionally, the practical exercises and application sections add immense value to the course, enabling students to apply their knowledge in real-life scenarios. This practical focus ensures that learners are not only able to understand the material but also to use it in their personal or professional lives, which is the ultimate goal of education.

While the course receives high marks across the board, it is not without its minor criticisms. Some students have mentioned the fast pace of information delivery and occasional issues with audio quality in earlier sections. However, these concerns are relatively minor when weighed against the overall quality and effectiveness of the course. The positive feedback from students, who have found the course to be more informative and engaging than traditional university courses, speaks volumes about its value.

In conclusion, Tax Accounting Made Easy to Understand stands out as a beacon of innovative education in tax accounting. Stefan Ignatovski’s unique approach to teaching, combined with the comprehensive and engaging content, makes this course a must-have for anyone looking to demystify the complexities of tax law. Whether you’re a student, a small business owner, or a professional looking to deepen your understanding of tax accounting, this course offers invaluable insights and knowledge, all while making the learning process enjoyable and effective.